What Can NDIS Funds Be Used For? A Simple Guide

So, you have your NDIS plan. That's a huge step! But now comes the next, and arguably most important, part: figuring out exactly what you can use your NDIS funds for. It’s easy to feel a bit lost at this stage, but it helps to think of your funding less like a single bank account and more like a personalised toolkit. Each tool, or budget category, is there for a specific job—all working together to help you build a more independent and fulfilling life.

The whole NDIS system is built on a single, core principle: funding reasonable and necessary supports. This is the key that unlocks what the NDIS will and won't cover. It’s the official test used to determine if a support or service is directly linked to your disability, offers good value, and is likely to be effective for you.

Think of it this way: the NDIS won't cover your weekly grocery bill, as that's an everyday living cost we all have. However, if your disability makes it challenging to shop or cook, the NDIS might fund a support worker to help with meal preparation. It’s about funding the support you need because of your disability, not the everyday item itself.

The Australian Government has established clear guidelines to make sure NDIS funding is used as intended—to improve your independence and community participation. This is why funds are channelled into specific, approved categories and not for general expenses or things that fall under other government systems like Medicare. If you want to dive deeper, you can explore the detailed government guidance on their official website.

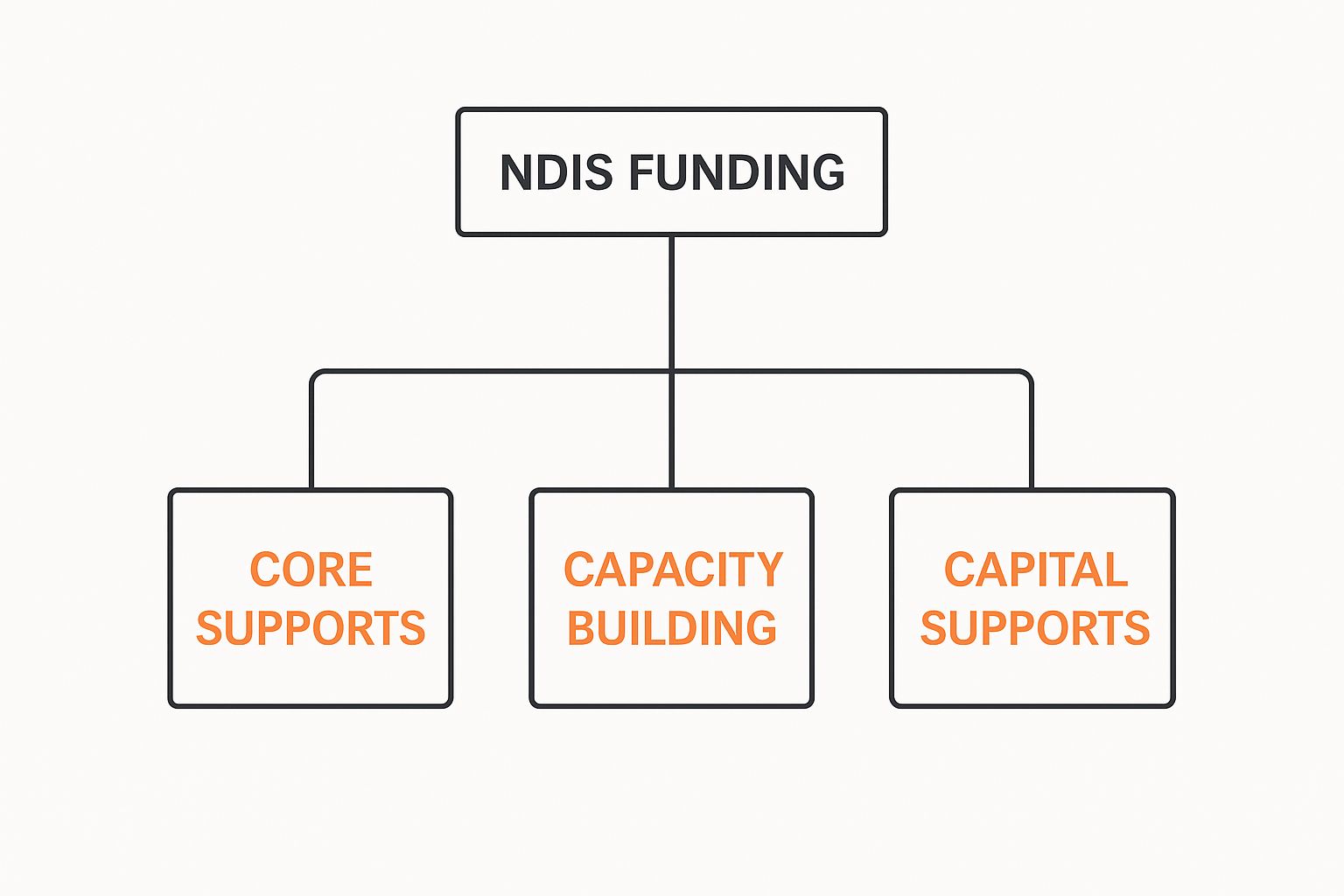

The Three Pillars of Your NDIS Budget

To help you manage your support needs effectively, your NDIS funding is organised into three distinct categories, or budgets. This structure isn't random; it’s designed to allocate funds to different, crucial areas of your life, from daily assistance to building skills for the future.

Let’s take a look at what these are and what they’re used for.

As you can see, each funding stream is designed to tackle different but equally important aspects of your support plan. Getting your head around this structure is the first real step in making your plan work for you.

To make it even clearer, here’s a quick breakdown of what each category typically covers.

Quick Guide to NDIS Funding Categories

| Funding Category | Primary Purpose | Common Examples |

|---|---|---|

| Core Supports | To help with everyday activities and daily life tasks. | A support worker for personal care, transport assistance to get to appointments, help with household chores, or joining a community group. |

| Capacity Building | To invest in building your skills and independence. | Occupational therapy, speech therapy, employment coaching, learning to use public transport, or improving your budgeting skills. |

| Capital Supports | For higher-cost assistive technology and modifications. | A specialised wheelchair, modifications to your bathroom or kitchen, vehicle modifications, or complex communication devices. |

Each of these categories plays a vital role. Core Supports are about the here and now, Capacity Building is your investment in future independence, and Capital Supports provide the essential, often big-ticket items that enable it all.

Making the Most of Your Core Supports in Everyday Life

Think of your Core Supports budget as the backbone of your NDIS plan. It’s your most versatile pool of funding, designed to cover the practical, hands-on help you need to navigate your day-to-day life and connect with your community. This is all about the 'here and now' support that makes independent living possible.

Life is rarely predictable, and the NDIS gets that. Your Core budget is deliberately flexible, allowing you to move funds between most of its categories. This is a huge plus, as it gives you the power to adapt your supports as your real-world needs change from one week to the next.

How Core Funding Works in Practice

The Core budget is split into four main categories, each aimed at a specific part of daily life. Getting your head around what each one covers is the first step to truly making your plan work for you.

Let’s break them down:

- Daily Activities: This is for your personal care and household tasks. It could mean having a support worker help you get ready in the morning, or assistance with cleaning and laundry if your disability makes these jobs tough.

- Consumables: This category pays for the everyday items you need specifically because of your disability. We’re talking about things like continence products, prescribed nutritional supplements, or low-cost assistive tech like specially designed cutlery or dressing aids.

- Social and Community Participation: This funding is your ticket to getting out and about. It can cover the cost of a support worker to go with you to a hobby class, a local club, or a social gathering, paying for their time while they support you.

- Transport: If your disability means you can’t use public transport without great difficulty, this funding helps you get where you need to go. It can pay for specialised transport services or cover the cost of a support worker driving you to work or appointments.

The real magic of Core Supports is in its flexibility. You might find that unallocated funds can be used for other reasonable and necessary supports, even if they seem to fit better under a different bucket, like therapy.

Getting the Best Value From Your Core Budget

Managing this budget well is the key to getting the right support, right when you need it. The fact that you can often shift money between Daily Activities, Consumables, and Social and Community Participation puts you in the driver's seat. For instance, if you don't use your full consumables budget one month, you could potentially redirect that money to pay for extra support to attend a community event.

But let’s be honest, navigating this flexibility can sometimes feel a bit tricky. That’s where getting some expert guidance can make all the difference. If you're struggling to figure out how to best use your funds or find the right providers, a support coordinator can be an incredible help.

It’s worth taking the time to explore what is support coordination and see how an expert can help you manage your plan. They have the experience to make sure your funding is spent in a way that genuinely helps you reach your goals.

How Capital Supports Fund Major Investments

While your Core Supports cover daily needs, your Capital Supports budget is for the big-ticket items. Think of it as funding for the foundational tools and structural changes that can dramatically improve your independence and safety, making everyday life far more accessible.

This part of your NDIS plan is much more structured than the Core budget. Funds in your Capital budget are usually earmarked for a very specific purpose and can't be shifted around. This is because these purchases are significant investments that often require detailed assessments and must clearly connect to your long-term disability-related goals.

The Capital budget is broken down into two main areas, each designed to make a real, lasting difference in your life. Knowing what fits into these categories is the first step to unlocking some of the most impactful supports the NDIS can offer.

Assistive Technology for Greater Independence

Assistive Technology (AT) is a broad category for items that help you do something that your disability might otherwise make difficult or impossible. It isn't just about high-tech gadgets; AT is any piece of equipment that helps you rely less on other supports and get more involved in your community.

These supports are often grouped by their complexity and cost. A few examples include:

- Mobility Equipment: This could be a power wheelchair built just for you, a specialised scooter, or modifications to a car so you can drive or travel more easily.

- Sensory Supports: Think of items like quality noise-cancelling headphones to manage sensory overload or assistive listening devices for hearing loss.

- Communication Devices: This covers everything from simple communication boards to advanced tech like eye-gaze systems or specialised software that gives you a voice.

- Recreational Aids: From handcycles to beach wheelchairs, this is equipment that helps you take part in sports and hobbies you love.

Home Modifications for a Safer Environment

The second key area of Capital Supports is Home Modifications. This funding is specifically for making physical, structural changes to your home so you can get around safely and live more independently. The aim is to remove the barriers in your living space that exist because of your disability.

It's important to remember these aren't cosmetic renovations like a new kitchen backsplash. Every modification must be directly linked to your disability needs and recommended by a qualified professional, like an Occupational Therapist.

Some of the most common home modifications we see funded are:

- Installing ramps to get in and out of the house.

- Modifying a bathroom with things like grab rails, a walk-in shower, or a ceiling hoist.

- Widening doorways so a wheelchair can pass through easily.

- Automating doors, blinds, or lights to make them easier to use.

Getting funding for these major investments nearly always involves getting formal assessments and quotes from specialists. It can feel like a complicated process, which is why having the right information is crucial. For more practical tips, check out our collection of Helpful NDIS Guides & Resources.

Building Skills with Capacity Building Supports

If your Core Supports budget helps with your "here and now," then your Capacity Building budget is your investment in the future. Think of it as a dedicated fund for building up your skills, boosting your confidence, and growing your independence over time. The whole idea is to help you learn and develop, so you might need less support down the track.

This is where some of the most empowering work in an NDIS plan happens. It’s all about giving you the tools and training to take on new challenges, whether that’s managing daily life more easily, finding a job, or pursuing social goals. Unlike your more flexible Core budget, these funds are earmarked for specific purposes and can't be moved around.

Investing in Your Personal Growth

Capacity Building is broken down into nine distinct categories, each targeting a specific area of skill development. Your NDIS plan will clearly state which categories you have funding for, and these are tied directly to the goals you’ve set. It’s a very personal and goal-oriented part of your plan.

A really common and powerful category is Improved Daily Living. This is where you’ll find the funding for therapies that build essential life skills.

- Occupational Therapy (OT): An OT can work with you on practical strategies for daily tasks. This might look like learning new ways to cook a meal safely, finding a system to organise your home, or building a solid morning routine.

- Speech Pathology: A speech pathologist helps with all things communication, from helping you express your needs clearly to building your confidence in connecting with others.

- Psychology: A psychologist can give you practical strategies for managing your emotions, understanding social cues, or developing coping mechanisms that work for you.

These therapies aren’t just about ticking boxes; they're about actively building your ability to live the life you want with more independence.

The real power of Capacity Building is its focus on outcomes. It’s not just about getting support for a task; it’s about learning skills that stay with you for life, making you less reliant on paid help in the long run.

From Learning to Doing

Another vital category is Increased Social & Community Participation. This funding is designed to help you build the skills and confidence to get out and be part of your community. For instance, you could use it to fund a mentor who helps you navigate social settings or supports you to join a local club that matches your hobbies.

In the same way, the Finding and Keeping a Job category provides supports that prepare you for success in the workplace. This could mean paying for a support worker to help you polish your resume, practice your interview skills, or even provide on-the-job coaching as you get comfortable in a new role.

Getting your head around the specific rules that govern how these funds can be used is key to making the most of your plan. For a deeper dive, exploring the official NDIS Policies and Procedures can give you valuable clarity and help you plan your supports with confidence. Ultimately, this budget empowers you to turn your long-term goals into reality.

What NDIS Funds Cannot Be Used For

Knowing what the NDIS can fund is only half the battle. Just as crucial is understanding what it can’t fund. Getting this wrong can lead to some real headaches, like having claims rejected and finding yourself out of pocket.

At its core, the NDIS is not a welfare system or a replacement for an income. It’s a very specific scheme designed to pay for supports that are directly related to your disability. It's built on a simple principle: the NDIS doesn’t cover everyday living costs that everyone, regardless of disability, has to pay for. These are often called ‘general exclusions’.

So, what does this look like in practice? It means your NDIS plan won’t cover things like:

- Your weekly grocery bill.

- Rent or mortgage payments.

- Standard household bills like electricity, gas, and water.

- Tickets to the footy, a concert, or the movies.

- General appliances like a new TV or a standard kettle.

A good rule of thumb is to ask yourself: "Is this a cost that most people have, or is it a cost that exists purely because of my disability?" If it falls into the first category, it’s almost certainly not something your NDIS plan can cover. The scheme is there to level the playing field, not to handle ordinary expenses.

Navigating the Grey Areas

Of course, it’s not always black and white. Sometimes the line between a disability support and a general exclusion can feel a bit blurry. This is where context and your personal goals become so important.

For example, while the NDIS won't buy your groceries, it might fund a support worker to help you with meal preparation if cooking is difficult due to your disability. Likewise, it won’t pay for a standard gym membership, but it could fund a personal trainer or support worker to help you exercise safely as part of your therapy goals.

It all comes back to that direct link to your disability needs and the goals in your plan. This is precisely why getting good advice from a plan manager or support coordinator can make all the difference when you’re figuring out how to use your budget.

To make this clearer, let’s look at a few examples side-by-side.

Eligible NDIS Supports vs General Exclusions

The table below breaks down common expenses, explaining why some are covered and others aren't, based on the 'reasonable and necessary' rule.

| Expense Type | Can NDIS Funds Be Used? | Why or Why Not? |

|---|---|---|

| Rent | No | This is a day-to-day living cost that is not a disability-specific support. |

| Home Modifications | Yes | Structural changes like ramps or grab rails are funded as they directly address disability-related access needs. |

| Groceries | No | Food is a general living expense for all Australians. |

| Therapeutic Supports | Yes | Therapies are funded to help you build skills and independence directly related to your disability. |

| Standard Laptop | No | This is considered a general household item that most people would be expected to own. |

| Communication Device | Yes | If a tablet or device is required for specific communication software, it is funded as essential assistive technology. |

Getting a firm grip on these rules gives you the power to use your plan confidently and effectively. It takes the stress out of wondering if a claim will be denied and ensures your funds are spent on the supports that truly matter.

The NDIS is always evolving, with guidelines and rules being tweaked to keep the scheme working well for everyone. Keeping an ear to the ground is a smart way to manage your plan. You can stay on top of the latest Industry News & NDIS Changes to make sure you're always getting the most out of your funding and planning with certainty.

Making Your NDIS Plan Work for You

Understanding what the NDIS can fund is just the first step. The real challenge—and where the magic happens—is turning that approved plan into tangible, life-changing support. Getting this right often comes down to how well you prepare, especially for your planning meetings.

Think of solid evidence as your best friend in this process. Before you even walk into that meeting, you'll want to have all your ducks in a row. This means gathering reports, letters, and assessments from your doctors, therapists, and any other allied health professionals you work with. These documents need to paint a clear picture of why a particular support is essential for you and how it directly relates to your disability.

Hand-in-hand with evidence is the need for clear, disability-focused goals. Your goals are the very heart of your NDIS plan; every single support funded by the NDIS must be a stepping stone towards achieving them.

Think of your goals as the destination on a map, and your funded supports as the car that will get you there. The NDIS can’t approve the funding for the journey if they don’t know where you’re trying to go.

Choosing How to Manage Your Funds

Once your plan gets the green light, you have a big decision to make: how will your funding be managed? This choice is about more than just paperwork; it shapes the level of control and flexibility you have over your supports. There are three main ways to handle your NDIS funds.

Each option comes with its own set of advantages and responsibilities, designed to suit different people and their circumstances.

- NDIA-Managed (or Agency-Managed): This is the most straightforward path. The National Disability Insurance Agency (NDIA) pays your providers directly from your budget. While it means less admin for you, it also means you can only use NDIS-registered providers.

- Plan-Managed: Here, a registered Plan Manager acts as your financial go-between, taking care of invoices and payments for you. This option offers a great middle ground, giving you the freedom to use both registered and non-registered providers without getting bogged down in financial admin.

- Self-Managed: If you want maximum choice and control, this is it. You manage your funds yourself, paying providers directly and then claiming the funds back from the NDIA. It's the most hands-on approach and requires you to be organised, but the flexibility is unmatched.

Choosing the right management style is a powerful move that helps you get the most out of your plan. Learning to advocate for yourself and understanding these options are crucial skills for anyone in the NDIS world. Sometimes, reading inspiring client stories and experiences can also offer brilliant insights and a bit of motivation for the journey ahead.

Got Questions About Using Your NDIS Funds? We've Got Answers.

It's completely normal to have questions when you're getting to grips with your NDIS plan. Let's walk through some of the most common queries we hear, so you can feel more confident about how your funding works.

Can I Use NDIS Funds for a Holiday?

This is a big one, and the short answer is generally no. The NDIS won't cover things like flights, hotels, or holiday activities because these are seen as everyday living costs that everyone has, regardless of disability.

But here’s the important exception: if you need a support worker to help you with your daily needs while you’re away, your NDIS plan can often cover the cost of their time and support. You’d still need to pay for your own travel and accommodation, plus the costs for your support worker (like their flight and room), but the funding for their actual hands-on support can come from your plan.

Can My Core Budget Buy an iPad?

Sometimes, but it’s not as simple as just buying one from the shop. An iPad or tablet can't be funded if it's just for entertainment, general schoolwork, or everyday browsing.

However, it might be approved under your plan as low-cost Assistive Technology if it’s essential for a specific need linked directly to your disability. A classic example is when a speech pathologist recommends a particular communication app that runs best on a tablet. In that case, the device is seen as the most cost-effective way to support your communication goals, making it a "reasonable and necessary" support.

The key is proving the device isn't just a nice-to-have, but a direct solution for a barrier your disability creates.

What's the Difference Between Plan and Self-Management?

Think of it like this: who's handling the bills?

With self-management, you're in the driver's seat. You pay your providers' invoices directly from your own bank account, then you log into the NDIS portal to claim that money back. It gives you maximum control.

With plan management, you get a third-party expert, your plan manager, to handle all the financial admin. You send invoices straight to them, and they pay your providers on your behalf using your NDIS funds. It gives you choice and flexibility without the headache of managing the paperwork yourself.

It's worth noting that the NDIS is always evolving. As of March 2025, while 27,675 new plans were approved, stricter eligibility is shifting some supports back to mainstream systems. You can always learn more about recent NDIS updates on their website.

Struggling to make sense of your plan? Navigator In Reach delivers expert NDIS support coordination across South Australia. We cut through the confusion and connect you with the right supports so you can focus on what matters. Find out how we can help.