NDIS Self Management Guide to Choice and Control

Ready to take charge of your NDIS plan? An NDIS self management guide is your key to unlocking genuine choice and control over your supports. When you decide to manage your funds yourself, you're not just a participant—you're the director, building a support team that truly understands your life and your goals.

Taking Control with NDIS Self Management

Choosing to self-manage your National Disability Insurance Scheme (NDIS) plan is a big move, but it’s one that puts you firmly in the driver’s seat. It's the difference between picking from a set menu and creating your own recipe for success.

Imagine finding the perfect therapist, someone who specialises in exactly what you need, but they aren’t NDIS-registered. With self-management, you can hire them. Or picture negotiating a better hourly rate with a support worker you trust for ongoing help. This is the real-world empowerment that self-management offers.

Yes, it comes with more admin work. But the trade-off is a plan that’s built by you, for you.

What Self-Management Really Means

At its heart, self-managing your NDIS plan boils down to three powerful elements:

- Choice: You get to decide on your supports and who provides them. This opens the door to providers who aren't registered with the NDIS, giving you a much wider pool of talent to draw from.

- Control: You are in charge of your budget. You pay your providers directly, and you set the schedule for when and how your supports are delivered.

- Flexibility: You can get creative with your funding across the Core, Capital, and Capacity Building categories to make sure every dollar is working towards your specific goals.

This hands-on approach is more popular than you might think. With approximately 717,001 active NDIS participants as of early 2025, it's significant that around 27% have chosen to fully or partially self-manage. It’s a clear sign that people want more say in their own support journey. You can always dig into the latest trends by checking out the NDIS quarterly reports.

The biggest win with self-management isn't just about the money. It's the deep sense of ownership you feel over your life. When you direct your own supports, you're not just receiving a service; you're the architect of your own future.

Is Self-Management a Good Fit for You?

Deciding how to manage your NDIS funding is a crucial first step. Each option offers a different balance of flexibility and administrative workload. Here’s a quick comparison to help you see where self-management fits in.

NDIS Management Options At a Glance

| Management Type | Provider Choice | Payment Responsibility | Best For |

|---|---|---|---|

| Self-Managed | Unrestricted—can use both NDIS registered and non-registered providers. | You pay invoices directly, claim funds from NDIS. | Individuals who want maximum choice, control, and are comfortable with financial admin. |

| Plan-Managed | Mostly unrestricted—can use registered and non-registered providers. | The Plan Manager pays invoices on your behalf. | People who want choice without the hassle of managing payments and record-keeping. |

| NDIA-Managed | Restricted—can only use NDIS-registered providers. | The NDIA pays providers directly from your plan. | Those who prefer a hands-off approach and want the NDIA to handle all financial aspects. |

Self-management works best for those who prefer more control, while the other options provide more support with the administrative side of things.

Taking the self-management path does require you to be organised and reasonably confident with handling money. You’ll be paying invoices, keeping clear records, and making sure every expense meets the 'reasonable and necessary' criteria set by the NDIA.

It’s definitely a hands-on role, but you don't need to be a financial whiz to make it work. For many people, a separate bank account and a simple spreadsheet are all it takes to stay on top of everything. The real key is just being willing to learn and keep things organised.

If you’re looking for a bit more guidance, our collection of helpful NDIS guides and resources can offer extra support as you get started.

Ultimately, choosing to self-manage is a powerful step towards independence. This guide is here to walk you through what you need to know to handle your plan with confidence, from setting up your budget to staying compliant.

So, you're thinking about self-managing your NDIS plan? That's fantastic. Taking direct control of your funding can be incredibly empowering, but the groundwork starts long before the money hits your account. Your first real step is in your planning meeting. This is where you need to clearly and confidently state your case for self-management.

You don’t need to be an accountant, but you do need to show the NDIA you’re organised and ready for the job. It's all about demonstrating that you've thought this through and can handle the responsibility. Think about how you'll explain your system for tracking spending and, more importantly, why having this direct control is the best way for you to achieve your NDIS goals.

Making Your Case for Self-Management

When you ask to self-manage, the planner will want to see that you're capable. This isn't a test you have to ace; it's more about showing you're prepared.

What does that look like in practice? Well, if you already use a spreadsheet or an app to manage your household bills, mention it! Have you already been researching potential providers online? That shows you're proactive. Your goal is to paint a clear picture of someone who is organised and ready to take the reins.

Here are a few practical things you could bring to the meeting:

- A simple budget template you’ve drafted up. This shows you’ve considered how to track your funds.

- A list of providers you’re interested in working with. This proves you've done your homework.

- A letter of support from a family member, therapist, or even a previous support coordinator who can vouch for your organisational skills.

The bottom line is that the NDIA needs to trust that you can manage public funds responsibly. When you walk into that meeting prepared and confident, it speaks volumes.

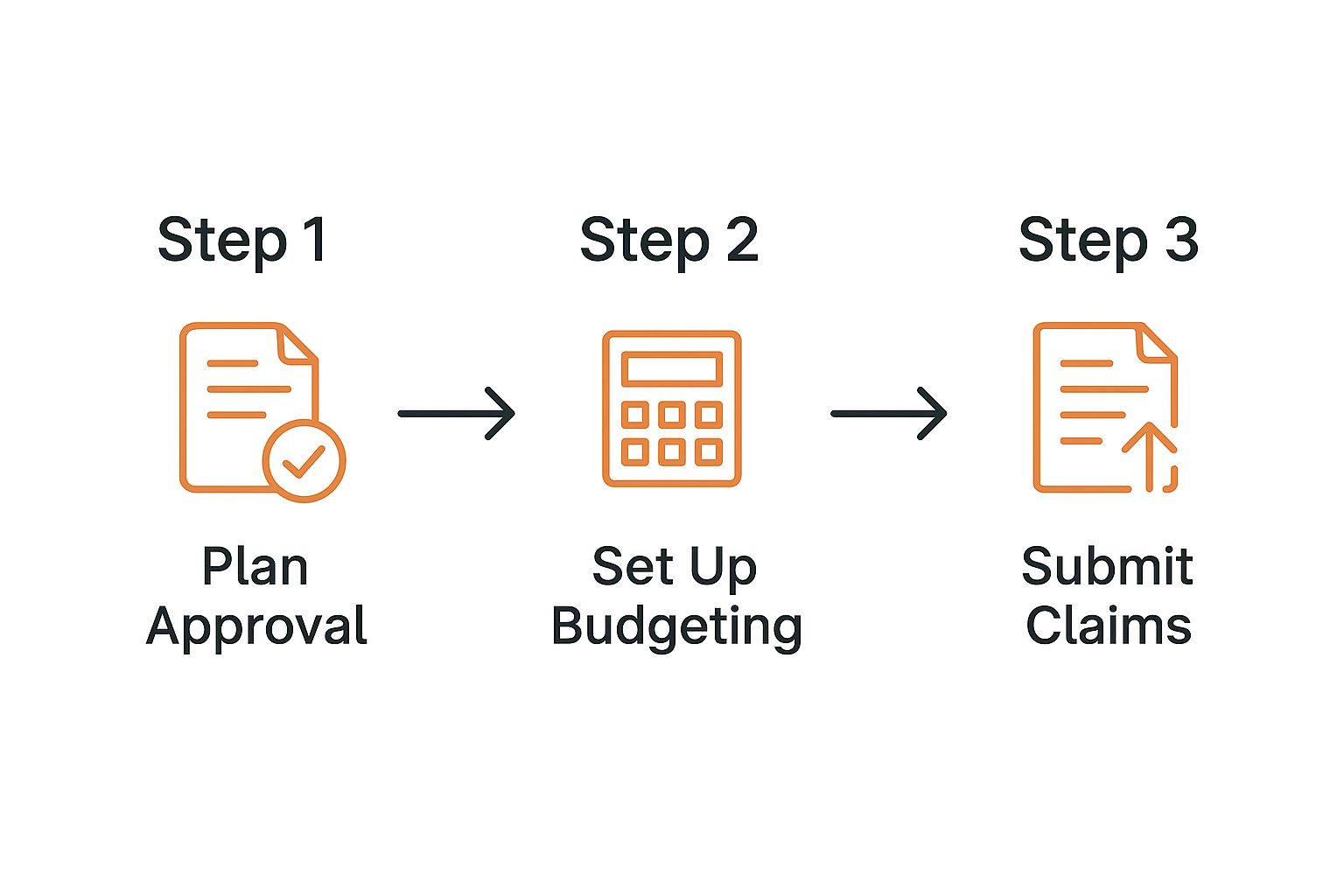

Once you get the green light and your self-managed plan is approved, it’s time to get everything set up properly. The first few steps are arguably the most important for keeping things simple and transparent down the line.

Your First Steps After Plan Approval

Getting that plan approval is a brilliant feeling! But before you do anything else, a couple of quick tasks will make your life so much easier.

Your absolute first priority is to open a separate, dedicated bank account. I can't stress this enough. Mixing NDIS funds with your everyday spending money is a recipe for disaster and can turn into a nightmare if you're ever audited.

This account is for one thing and one thing only: your NDIS funding. All your NDIS payments go in, and all your provider payments come out. Simple. It creates a clean, straightforward record of every dollar. Most banks offer basic, fee-free accounts that are perfect for this.

This whole process, from approval to payment, really hinges on having a clear system in place.

As you can see, organised budgeting is the crucial link between receiving your funds and actually using them to achieve your goals.

Understanding Your Plan's Budget

With your new bank account open, it's time to get to know your funding inside and out. Your NDIS plan is broken down into three main support categories, and understanding what they're for is the key to successfully self-managing.

Here’s a quick rundown:

Core Supports: Think of this as your most flexible bucket of money. It’s designed for everyday supports that help you with daily life—things like personal care, transport, or consumables (like continence aids). You generally have a lot of freedom to use these funds across different Core areas as your needs change.

Capital Supports: This budget is much more rigid. It’s for bigger ticket items and investments, primarily assistive technology (like a specialised wheelchair) or home modifications. You can't just move money out of this category to pay for something else.

Capacity Building: Just like the name suggests, this category is about building your skills and independence for the long term. It funds things like therapy, learning new life skills, or getting help from a support coordinator. The aim is to build your ability to live more autonomously over time.

Getting your head around these distinctions is vital. For example, while your Core budget is flexible, you can’t dip into it to pay for something that clearly falls under Capital. To stay on the right side of the rules, you can review our guide on NDIS policies and procedures to make sure you’re always compliant.

A great way to start is by mapping out your budget allocations directly against the goals in your plan. If one of your goals is to get out into the community more, you would allocate funds from your Core budget to pay for a support worker to help you do just that. This is where your plan starts becoming a reality.

Getting a Handle on Your NDIS Budget and Payments

Alright, this is where the rubber really hits the road. We're moving past the theory and into the day-to-day reality of managing your own funds. Honestly, getting this part right is the absolute key to making self-management work for you.

When you master your budget, you have a crystal-clear, up-to-the-minute picture of where every dollar is going. And don't worry, this doesn't mean you need to be a finance whiz or buy fancy accounting software. The best system is simply the one you’ll actually stick with.

Choosing How You'll Track Your Spending

Your tracking method can be as simple or as sophisticated as you need it to be. The real aim here is clarity and consistency, not complexity. For a lot of people I've worked with, a basic spreadsheet is all they need to stay on top of things.

You could set up a simple digital spreadsheet with columns for:

- Date: When you received the service.

- Provider: Who delivered the support.

- Description: A quick note like "Physio session" or "Transport to appointment."

- Cost: The invoiced amount.

- Support Category: Which bucket of funding it came from (e.g., Core, Capacity Building).

- Remaining Budget: A running total so you can see what's left in each category at a glance.

If spreadsheets aren't your thing, you might prefer a dedicated budgeting app. Some people find apps like Frollo or Pocketbook incredibly helpful. You can link them to your NDIS bank account, and they'll often categorise your spending automatically, giving you a visual snapshot of your budget. It's a more hands-off way to see where you stand financially.

The real power of tracking isn't just about looking backwards at what you've spent. It's about empowering your future choices. Knowing exactly how much you have left in your Core budget gives you the confidence to decide whether you can book that extra support shift next week.

Making the NDIS Price Guide Work for You

Here's an insider tip: even though self-managers aren't strictly bound by the official NDIS price limits, the NDIS Pricing Arrangements and Price Limits document is one of your best friends. Don't think of it as a set of rules, but as a strategic benchmark.

When you're talking to a new provider, knowing the NDIS price limit for a particular support gives you a solid starting point for negotiations. It helps you figure out if you're getting good value for money. If a provider quotes a price that's way higher, you're in a great position to ask them to explain the difference. And if their rate is lower? You know you've found a great deal.

It’s also smart to keep an eye on the annual updates to these pricing arrangements, as they reflect what's happening in the economy. For instance, the 2025 NDIS Price Guide, which kicked in on 1 July 2025, brought an average indexation increase of 4.36% to many support items to cover rising wages and inflation. Knowing this helps you have more informed conversations with your providers about their rates. You can find more detail about the latest NDIS price updates and what they mean for you on achora.com.au.

A Real-World Example of Budget Flexibility

Let's see how this plays out in real life. Imagine Alex, who self-manages his plan. Most of his Core Supports budget goes towards a support worker who helps him with daily tasks and getting out into the community three times a week.

One month, his specialised wheelchair needs a small but urgent repair costing $300, which his Capital budget doesn't cover. Instead of stressing, Alex pulls up his budget tracker. He sees that if he swaps one of his community access shifts for a less expensive activity at home that week, he can easily free up the funds within his flexible Core budget. Just like that, the repair is covered.

This is the very essence of self-management. Alex didn't have to ask anyone for permission or go through a lengthy plan review. He saw a problem, checked his budget, and moved funds around to fix it on his own terms. This kind of immediate, responsive control is something you simply can't get with any other management style.

How to Create and Pay Invoices the Right Way

Paying for supports is a straightforward process, but you need to be meticulous to stay compliant with NDIS rules. Every time you pay an invoice, you're confirming that the support was "reasonable and necessary."

When a provider sends you an invoice, it must have specific details to be valid for an NDIS claim.

Your Invoice Checklist:

- Provider's name and ABN

- Your full name as the participant

- A unique invoice number and the date

- The dates the support was actually delivered

- A clear description of what the support was

- The quantity and rate (e.g., 2 hours @ $65/hr)

- The final total amount due

Once you have a compliant invoice, you pay the provider directly from your dedicated NDIS bank account. The next step is to log into the myplace portal or use the My NDIS app to submit a payment request. The NDIA will then reimburse that money straight back into your account, usually within 24-48 hours. This simple "pay, then claim" cycle keeps your cash flow healthy and your records squeaky clean.

Finding and Managing Your Support Team

Now that you've got your budget sorted and your bank account is ready to go, we can get to the heart of it: building the team of people who will support you. Honestly, this is one of the biggest reasons people choose to self-manage in the first place. You get complete freedom to assemble a team that genuinely understands and fits into your life.

Forget being stuck with a pre-approved list of NDIS-registered organisations. Self-management opens up a much wider world of support. You might find an independent support worker who just gets you, a local therapist who’s perfect for your needs, or even a community group that aligns perfectly with your goals but hasn't gone through the NDIS registration hoops.

Expanding Your Search for the Right Support

Your pool of potential support just got a lot bigger. You can absolutely still work with traditional NDIS-registered providers if they're the best fit, but you’re no longer limited to them.

This freedom of choice is a game-changer. Across Australia, a whole ecosystem of platforms and services has sprung up to help self-managers. A great example is an online platform like Mable, which lets you connect directly with independent support workers. It puts you in the driver's seat, giving you a direct line to choose the people you work with.

It can feel like a big job finding the right people, but remember, you’re the boss here. You can interview potential support workers just like you would for any important role, making sure they have the right skills, personality, and approach. For some, a Support Coordinator can be a fantastic ally in this search. If you're curious, you can learn more by reading our guide on what is support coordination and how they can help you connect with the right providers.

My Two Cents: The single most important document between you and your provider is the service agreement. Don't think of it as just paperwork. It's a shared roadmap that protects both you and your support worker, heading off misunderstandings before they even start.

Crafting a Rock-Solid Service Agreement

A service agreement is simply a written document that clearly lays out the arrangement between you and your provider. While it's not always mandatory for self-managers, I can't recommend it enough. It’s the playbook for your working relationship, ensuring everyone is on the same page from day one.

A good service agreement acts as a clear reference point, detailing everyone's responsibilities and what to do if things don't quite go to plan.

Here’s a quick checklist for what to include:

- Scope of Services: Be specific. Instead of just "community access," spell out "support for weekly grocery shopping and attending Tuesday hydrotherapy sessions."

- Payment Rates and Terms: Clearly state the agreed-upon hourly rate. Specify how and when invoices should be sent and your timeframe for payment.

- Schedule of Supports: Lock in the days and times support will happen.

- Cancellation Policy: What’s the process if you need to cancel a shift? What if the provider cancels? Define notice periods and any fees involved.

- Review and Termination: Include a clause about when you'll both review the agreement and the steps for ending it if it’s no longer working out.

Your Responsibilities When Employing Supports Directly

When you pay a provider who is a sole trader or works for an organisation, they handle their own tax, superannuation, and insurance. Easy. However, some self-managers take it a step further and choose to directly employ their support workers. This path is less common but offers the absolute maximum level of control.

Just be aware that if you decide to become a direct employer, you are taking on some serious legal and financial responsibilities. It's critical to know what you're getting into.

Essential Employer Considerations:

- Superannuation: You are legally required to pay super contributions for your employee.

- Insurance: You must have workers' compensation insurance to cover your employee if they are injured at work.

- PAYG Withholding: You’ll need to withhold tax from your employee's wages and send it to the Australian Taxation Office (ATO).

- Fair Work Standards: You have to follow all national employment standards, which cover things like minimum wage, leave, and providing payslips.

Taking on these duties is a massive commitment. Before you even think about going down this road, get professional advice from an accountant or a disability employment service to make sure you're ticking all the right boxes. For most people using this ndis self management guide, sticking with independent contractors is the far more straightforward option.

Keeping Records and Staying Compliant

Let's be honest, the word "compliance" can sound a bit daunting. But it really doesn’t have to be. Think of it less like a rigid set of rules and more like a straightforward system for accountability.

Nailing this part of your self-management journey is what will give you the freedom and confidence to use your NDIS funds creatively. It means you can face any plan review or audit without a hint of stress.

At the end of the day, compliance boils down to two simple things: keeping good records and making sure every dollar you spend passes the ‘reasonable and necessary’ test. This test is just the NDIA's way of ensuring your funding is used exactly as intended—to help you kick your goals.

What Does ‘Reasonable and Necessary’ Actually Mean?

This is probably the most common question I hear, and for a good reason. The phrase seems a bit vague on the surface, but it's more straightforward than you might think.

A support or service is considered ‘reasonable and necessary’ if it:

- Directly relates to your disability.

- Helps you achieve your plan goals.

- Represents good value for money.

Let’s walk through a real-world example. Say one of your NDIS goals is to improve your physical fitness and get more involved in your community.

- A valid claim: You could pay for a support worker to go with you to the local gym each week. This directly helps you participate in a community activity and work towards your fitness goal.

- An invalid claim: You couldn't use your NDIS funds to pay for the gym membership itself. A gym membership is an everyday living expense that anyone, with or without a disability, might have.

See the difference? Your NDIS funds cover the disability-related support you need to get to and use the gym, not the everyday cost of the gym itself.

Your Essential Record-Keeping Checklist

When you self-manage, good record-keeping is your best friend. It’s the proof in your pocket that shows you’ve used your funding correctly and responsibly. The NDIA recommends you keep all records for at least five years, so it’s crucial to set up a system that’s simple and organised from day one.

Whether you're a digital person with a folder on your computer or you prefer an old-school physical binder, consistency is what matters most.

Here’s exactly what you need to keep for every single purchase you make:

- Invoices and Receipts: These are non-negotiable. Every invoice needs to be clear, itemised, and show the provider's ABN. Your receipts are your proof of payment.

- Service Agreements: These documents map out the arrangement you have with a provider. They are vital for showing that the support was agreed upon and professionally arranged.

- Proof of Goal Connection: This doesn't have to be complicated! It can be a simple note in your budget spreadsheet, like, "Physio session - supports goal to improve mobility." For bigger purchases, a letter from a therapist recommending the item is gold-standard evidence.

Your records tell the story of your NDIS journey. They show how each support you’ve chosen is a deliberate step towards achieving your goals, proving you are an effective and responsible manager of your plan.

Storing Your Records Securely and Simply

Getting your documents in order doesn't have to feel like a chore. A logical filing system is all it takes to stay on top of everything.

Think about what makes the most sense to you. Some people like to file documents by the provider's name. Others find it easier to organise everything by the NDIS budget category (Core, Capital, Capacity Building). The method itself doesn't matter nearly as much as your ability to find a specific document when you need it.

For those looking for a bit of structure, you might find our collection of forms and resources for NDIS management helpful.

Submitting a Payment Request

Once you've paid a provider's invoice from your dedicated bank account, the final piece of the puzzle is getting reimbursed by the NDIA. You'll do this by making a payment request through the my NDIS app or the myplace portal.

The process is refreshingly quick. You'll just need to enter some basic details from the invoice, like the provider's ABN, the date the support was delivered, and the amount you paid.

After you submit the request, the NDIA typically processes the reimbursement within 24 to 48 hours, sending the money straight back into your NDIS bank account. Getting this simple "pay and claim" cycle down pat is the final step to managing your plan with complete autonomy and confidence.

Answering Your Top Self-Management Questions

Once you decide to self-manage, a whole new set of questions tends to pop up. It’s one thing to understand the concept, but another to handle the day-to-day details. That's perfectly normal. We've gathered some of the most common questions we hear from people just starting out, and we’re here to give you clear, straightforward answers.

Can I Pay a Family Member for Support?

This is easily one of the most asked questions, and the answer is usually no. The NDIS has pretty firm rules against using your funding to pay close family members for support they'd typically provide. The reasoning is to avoid potential conflicts of interest and keep the support arrangement professional.

There are, however, some very rare exceptions. If you live in a remote area with no other providers, or if you require highly specialised care that only a family member can provide, the NDIA might consider it. This isn't a simple handshake deal, though. It has to be thoroughly justified, discussed in your planning meeting, and written explicitly into your NDIS plan as a last resort.

For most people, the best path forward is to engage professional, independent providers. This creates clear boundaries and ensures accountability. Seeing how others have built their support teams can offer some great ideas; feel free to explore these client stories and experiences to learn from their journeys.

What Happens If I Overspend My Budget?

This is a big one. When you self-manage, you take on full responsibility for your budget. If you overspend in any category, you are personally responsible for covering that extra cost. The NDIS won't step in with more funds to cover a shortfall.

This is exactly why keeping a close eye on your budget isn't just a good idea—it's essential. Whether you're using a spreadsheet or a dedicated app, that tool is your financial safeguard. It gives you a live look at where your money is going, so you can make smart decisions before you spend.

Think of your budget as a fuel gauge in a car. You wouldn't start a long trip without checking it. If you see one support category getting low, you can either scale back your spending or, if your plan allows, move funds from a more flexible budget like your Core Supports to top it up.

If your needs have genuinely changed and your plan is no longer sufficient, don't just overspend and hope for the best. The proper process is to request a plan review. You can then provide evidence of your new circumstances and make a case for why your funding needs to be adjusted moving forward.

Do I Need an ABN to Self-Manage My Plan?

Nope, you absolutely do not need an Australian Business Number (ABN) to self-manage your NDIS plan. You are acting as the manager of your own plan, not as a business providing services.

The key thing to remember is that the providers you hire must have their own ABN. This is non-negotiable. Every invoice you receive must clearly display the provider's valid ABN. It doesn't matter if they're a sole trader therapist or a local gardening service—checking for an ABN before you pay is a crucial part of your record-keeping and compliance duties.

How Do I Prove a Support Is ‘Reasonable and Necessary’?

Proving a support is "reasonable and necessary" really just means drawing a clear, logical line from the purchase back to a specific goal in your NDIS plan. It's about making sure your records tell a coherent story.

Here's how to build a rock-solid case for any support you buy:

- Link it to a goal: You should be able to finish this sentence for any purchase: "I bought this to help me achieve my goal of..."

- Gather supporting documents: An email or report from an occupational therapist recommending a specific piece of assistive tech is gold. Keep it.

- Demonstrate value for money: Make notes on why you picked a certain product or provider. Did you compare a few options? Does it provide a clear long-term benefit?

For instance, say you claim for a support worker to drive you to a weekly art class. The justification is simple: it directly supports your plan goal of "increasing community participation and learning new skills." The invoice from the support worker, combined with your own notes, creates the perfect evidence trail. This kind of simple, consistent documentation will give you total confidence in how you're using your funds.

At NIR Navigator In Reach, we believe in making the NDIS journey clearer and more manageable. If you're looking for a partner in South Australia to help you cut through the complexity and connect with the right supports, we're here to help. Find out how our support coordination can make a difference for you at https://navigatorinreach.com.