What Is NDIS Plan Management? A Simple Guide

Think of NDIS plan management as having a personal bookkeeper for your NDIS funds. It’s a support service designed to give you the freedom to choose your own providers—even those who aren’t NDIS-registered—without you having to deal with the headache of paying invoices and tracking spending. Essentially, a plan manager takes care of all the financial administration for you.

Understanding Your 3 NDIS Funding Options

Once your NDIS plan is approved, one of the first big decisions you'll make is how the funds in it will be managed. You have three distinct pathways to choose from, and each one strikes a different balance between flexibility, choice, and how much admin you need to do yourself.

Getting your head around what NDIS plan management is really starts with seeing how it stacks up against the other two options. The choice you make here will directly shape which service providers you can work with and how much paperwork lands on your desk.

The Three Management Choices Explained

The National Disability Insurance Agency (NDIA) puts you in the driver's seat, letting you pick the method that best fits your lifestyle, support needs, and personal goals.

Here are the three ways you can manage your plan funding:

- Agency-Managed (or NDIA-Managed): In this setup, the NDIA pays your providers directly from your plan's budget. It's the most hands-off option, but the trade-off is that you can only use NDIS-registered providers.

- Self-Managed: You take on full control and responsibility for managing your NDIS budget. This route gives you the greatest flexibility to use any provider, but it also means you’re in charge of paying all the invoices, keeping meticulous records, and making sure you follow all the NDIS rules.

- Plan-Managed: This is the popular middle-ground option. A plan manager acts as your financial go-between, handling all the invoicing and payment tasks on your behalf. This gives you the same freedom and choice as self-management but without the administrative burden.

To help you see the differences at a glance, here’s a quick comparison of how the three options work in practice.

How the 3 NDIS Funding Options Compare

| Management Option | Provider Choice | Who Pays Invoices? | Best For Participants Who... |

|---|---|---|---|

| Agency-Managed | NDIS-registered providers only | The NDIA | Want the simplest, most hands-off process. |

| Self-Managed | Any provider (registered or not) | You (the participant) | Want maximum control and are happy to handle the financial admin. |

| Plan-Managed | Any provider (registered or not) | Your Plan Manager | Want choice and flexibility without the stress of managing payments. |

As you can see, plan management gives you the best of both worlds.

Plan management strikes that perfect balance. It empowers you with choice and control over your supports, while a professional partner takes care of the financial side to make sure your providers are paid correctly and on time.

This means you can get back to focusing on what’s most important—working towards your goals and building a more independent life.

Best of all, the funding for a plan manager is an additional amount added to your plan under the 'Improved Life Choices' category. It never comes out of the budget for your other supports. It’s a fully-funded service included in your plan specifically to make your NDIS journey smoother.

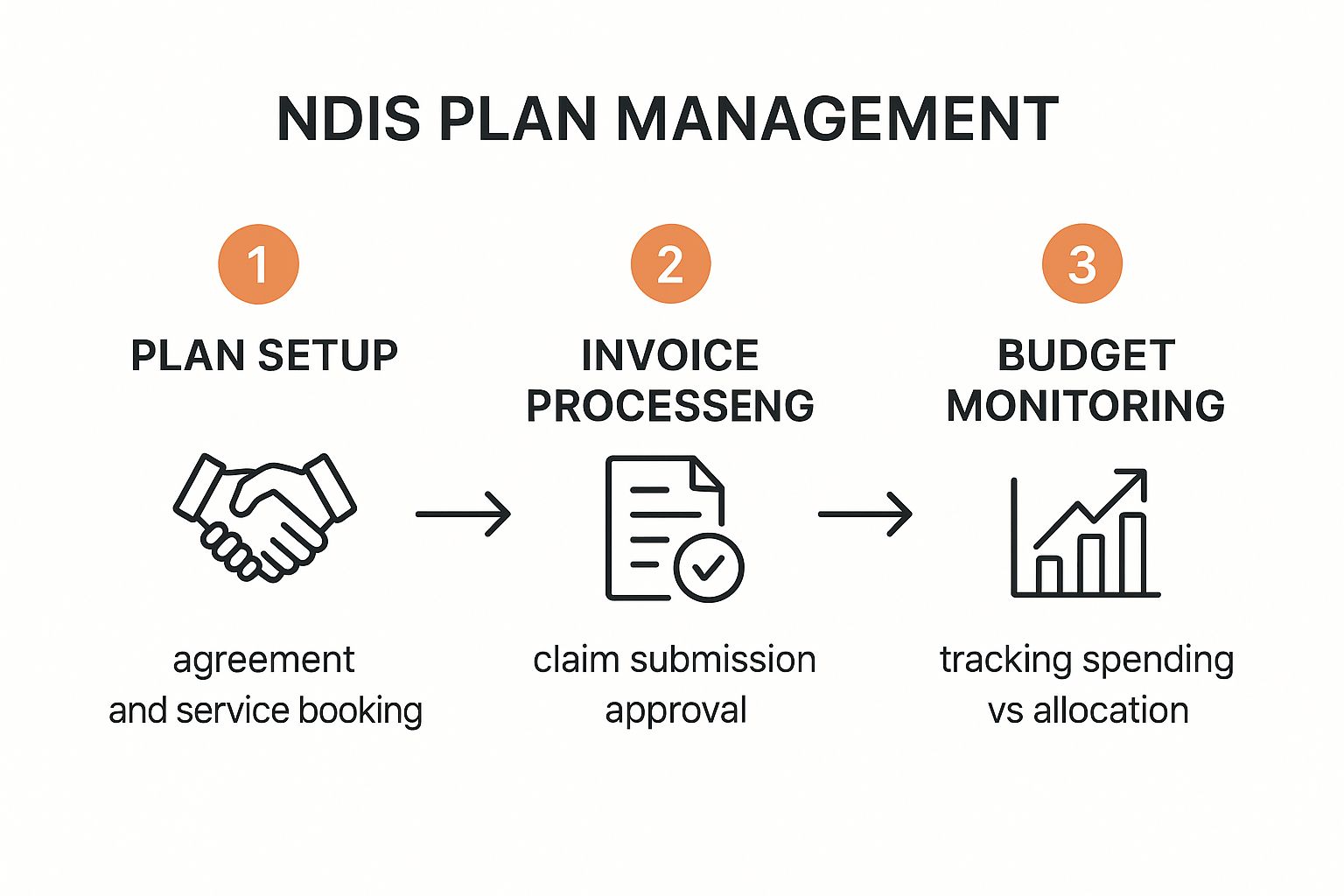

How Plan Management Works Step-by-Step

Seeing how plan management works in practice is the best way to really understand what it’s all about. The whole process is designed to take the financial admin off your plate, freeing you up to focus on what truly matters: getting the right support. It all kicks off when you first get your NDIS plan sorted.

All you have to do is request plan management during your planning meeting. The NDIA will then add dedicated funding for it into your plan, which you'll find under the ‘Improved Life Choices’ support category. This is a critical point: this funding is an extra, so it never reduces the funds available for your core supports.

Setting Up With Your Plan Manager

Once your NDIS plan is approved with funding for plan management, your first real step is to choose a plan manager. You'll sign a service agreement with them, which is just a document that clearly lays out how you'll work together, what they're responsible for, and how they’ll keep you in the loop. Think of it as the official start of your partnership.

After you're all set up, your plan manager gets to work creating service bookings in the NDIS portal. This is like putting a "hold" on the funds for your chosen providers, making sure the money is reserved and ready to go when their invoices start coming in.

This handy visual below maps out the journey, from getting set up right through to keeping an eye on your budget.

As you can see, it’s a simple cycle of setting up, processing payments, and monitoring your funds, all designed to keep things running smoothly and transparently.

Processing Invoices and Payments

This is where you’ll really feel the benefit of having a plan manager. Instead of you juggling invoices, your support providers—whether they're NDIS-registered or not—send their bills straight to your plan manager. It immediately takes the daily paperwork headache away from you.

Your plan manager then does a few crucial checks:

- Verifies the Invoice: They make sure the services were actually delivered and that the costs line up with the NDIS Pricing Arrangements and Price Limits.

- Claims the Funds: They then submit a payment request through the myplace portal, claiming the exact invoice amount from your plan budget.

- Pays the Provider: As soon as the NDIA processes that claim, your plan manager pays the provider’s invoice. This keeps things prompt and professional, helping you maintain great relationships with your support team.

Monitoring Your Budget and Staying on Track

A great plan manager does much more than just pay the bills. They’re also your financial co-pilot, providing you with regular, easy-to-understand budget reports. These statements clearly show you how much you’ve spent, what’s left in each support category, and help you pace your spending throughout your plan.

This kind of careful financial oversight is vital for the long-term health of the entire NDIS scheme.

The National Disability Insurance Scheme is a significant investment in Australians with disability. For the nine months to March 2024, scheme expenses were $34.2 billion, which was actually $740 million (2.1%) below the projected forecast.

This careful management is what keeps the NDIS on a path to financial sustainability, with a target of 8% cost growth by mid-2026. For anyone interested in the nitty-gritty, you can read the NDIS quarterly report highlights.

Ultimately, this proactive budget tracking empowers you. It gives you the information you need to make smart decisions, avoid overspending, and make sure your funds last for your entire plan period.

To keep building your NDIS knowledge, feel free to explore our other helpful NDIS guides and resources.

The Real-World Benefits of Plan Management

Choosing to have your plan managed might seem like just another financial decision, but its real value runs much deeper. It’s about giving you a unique mix of freedom, choice, and convenience that genuinely improves your NDIS experience. Think of it as clearing away the hurdles so you can get on with what matters—reaching your goals.

At its heart, plan management is all about choice. It frees you from being restricted to only using NDIS-registered providers. This one benefit alone opens up a whole new world of support options that might be a much better fit for your specific needs.

Imagine you’ve found a brilliant local therapist or a community group that perfectly understands you, but they aren’t registered with the NDIS. With plan management, you can still use their services. This gives you the ultimate flexibility to piece together the support network that works best for you, not just the one that’s on an official list.

Freedom From Financial Admin

One of the first things you'll notice is the huge weight lifted off your shoulders when it comes to paperwork. If you've ever felt bogged down by bookkeeping, chasing up invoices, or wrestling with the NDIS payment portal, plan management is a game-changer.

Your plan manager steps in and takes over all that time-consuming admin. They become your financial go-to, handling all the details:

- Receiving and Checking Invoices: They make sure every bill from your providers is accurate and has all the right information.

- Prompt Payments: They handle the whole process—claiming funds from the NDIA and paying your providers on time, every time.

- Record Keeping: All your financial records are kept neatly organised and compliant, giving you complete peace of mind.

This frees you up. Suddenly, you have more time and mental energy to focus on your personal and developmental goals. You get all the perks of expert financial oversight without needing to become an accountant yourself.

Plan management provides a crucial safety net. It ensures that every dollar from your plan is spent correctly according to NDIS rules, safeguarding your funding and helping you build sustainable, long-term relationships with your providers.

Expert Financial Support and Budget Clarity

A good plan manager does more than just pay the bills; they act as your financial guide on your NDIS journey. You'll get clear, easy-to-read monthly statements showing exactly where your funding is going. This kind of transparency is the key to making smart, confident decisions about your budget.

With these regular updates, you can easily track your spending, see how much you have left in each support category, and make sure your funds will last for your entire plan. It’s this financial clarity that truly keeps you in the driver’s seat.

If you’re interested in the nitty-gritty, you can learn more about the official NDIS policies and procedures that guide how plan managers operate. This expert backing ensures every payment is compliant, protecting you from headaches and helping you get the most value out of every single dollar in your plan.

Is Plan Management the Right Choice for You?

Deciding how to manage your NDIS funds is a deeply personal choice. There’s no single right answer—it all comes down to your unique needs, goals, and how you want to handle the day-to-day details of your plan.

Plan management often shines brightest for people who feel caught in the middle. They want the total freedom that comes with self-management but feel overwhelmed by the thought of all the financial paperwork.

To figure out if it’s the best fit, let's see if any of these common scenarios sound familiar.

Who Benefits Most from Plan Management?

Do you love the idea of having complete flexibility and choice over your providers, but the thought of processing invoices, tracking spending, and keeping perfect records makes you anxious? If that’s a yes, then plan management was practically designed for you. It lets you hand off all the financial admin to an expert, so you can keep the control you want without the stress you don't.

Or maybe you’re a family who has found the perfect local therapist, but you discover they aren’t a registered NDIS provider. This is where plan management is a game-changer. It bridges that gap, allowing you to work with any provider you choose, whether they're registered with the NDIS or not. This opens up a much wider network of support, so you’re never limited by someone’s registration status.

Think of it this way: plan management is for anyone who would rather spend their time and energy on achieving their goals, not getting bogged down in administrative headaches. You get clear, professional budget reports without ever having to build a spreadsheet yourself.

Ultimately, it’s about freeing you up to focus on what truly matters. And it's a model that’s becoming more and more popular for exactly that reason.

The numbers tell the same story. Recent data shows that of all active providers, a massive 191,467 were working with plan-managed participants. This figure is far higher than those for Agency-managed (9,415) and self-managed (132,419) participants, highlighting its role as a leading choice across Australia. You can see the full breakdown of these NDIS provider distribution figures on the NDIS website.

Making Your Decision

Choosing plan management means you’re entering into a structured partnership. You and your plan manager will lay out how you'll work together in a formal document, making sure everything is clear from the start.

To get a better sense of what this looks like in practice, you can read about our service agreements and understand how they work to protect you.

If you’re looking for the best of both worlds—the freedom to choose your supports and the relief from financial stress—then plan management is very likely the right path for your NDIS journey.

How to Choose a Great NDIS Plan Manager

Picking the right plan manager is easily one of the most critical decisions you'll make on your NDIS journey. This relationship is the key to a smooth, stress-free experience, so it really pays to look beyond the basic promise of "we pay your invoices." A truly great plan manager is a responsive, reliable partner in your corner.

Feeling confident in your choice comes down to knowing what to look for and which questions to ask. Things like communication style, the technology they use, and their reputation for customer service are just as important as their ability to process a payment. You're entrusting them with your funding, so that trust needs to be earned.

Key Factors to Consider

Before you sign on the dotted line, it’s a good idea to dig into a few key areas that separate a high-quality plan manager from the rest. Don’t ever feel shy about interviewing a few different providers to find one that feels like the right fit for you and your specific needs.

Here are the essential things to investigate:

- Communication: How will they keep you in the loop? Do they send regular budget summaries and alerts? Look for providers who are proactive and clear in how they communicate.

- Technology: Is there a user-friendly app or online portal? Being able to easily check your budget, approve invoices, and see your spending in real-time from your phone is a massive advantage.

- Customer Service: What’s their reputation for being helpful and easy to reach? Check out online reviews and see how quickly they respond to your first enquiry. Fast, friendly service from the get-go is a fantastic sign.

- Invoice Processing Speed: Slow payments can put a real strain on the relationships you have with your support providers. Ask them directly about their average invoice processing time to make sure your team gets paid promptly.

Choosing a plan manager is about more than just financial processing; it's about finding a partner who empowers you. A great manager will provide the tools and support you need to make informed decisions, maximise your budget, and achieve your goals with confidence.

Stability in a Changing Market

The NDIS plan management space is going through some major shifts right now. Industry analysis suggests the number of active plan managers in Australia is likely to drop significantly, mostly due to financial pressures hitting smaller businesses the hardest. For participants, this could mean fewer choices and the risk of dealing with slower, less responsive service.

This makes choosing a stable, well-established, and reliable provider more important than ever. You want a partner who will be there for the long haul, delivering consistent, high-quality support without any interruptions.

Make sure you fully understand the terms of your agreement. A great starting point is checking out our guides on NDIS contracts and service agreements. A little bit of diligence now will pay off in a big way down the track.

Frequently Asked Questions About Plan Management

As you weigh up your options, a few last-minute questions often come to mind. Getting a clear picture of the finer details is what gives you the confidence to make the right call for your situation.

Let's walk through some of the most common queries we hear.

Does Plan Management Cost Extra?

This is a big one, and the answer is refreshingly simple: no, it doesn't cost you a cent. The National Disability Insurance Agency (NDIA) includes separate funding in your NDIS plan specifically to cover your plan manager's fees.

This funding sits in a category called 'Improved Life Choices'. It's completely separate from the budgets for your therapies, equipment, or support workers. Think of it as a dedicated administrative fund provided by the NDIS to make your life easier.

You get all the benefits of having a professional handle your NDIS finances without it ever taking away from the funding you need for your other supports. It’s a built-in feature of the scheme, designed to give you more choice and control.

This setup ensures that anyone who wants or needs a plan manager can access one without being out of pocket, making it a truly accessible option for all participants.

Can I Switch to Plan Management at Any Time?

Absolutely. You're never locked into one management style for your entire plan. The NDIS is designed to be flexible and adapt to your changing needs.

If you start out self-managing or agency-managing and decide you want to switch, you have a couple of options:

- At your plan reassessment: This is the perfect time to discuss what’s working and what isn’t, and to ask for plan management to be included in your next plan.

- By requesting a plan variation: You don’t have to wait until your reassessment is due. You can contact your NDIS planner or Local Area Coordinator (LAC) at any point and ask to add plan management to your current plan.

The NDIS is always evolving, so staying on top of the latest rules is important. For updates, it's a good idea to keep an eye on NDIS changes and industry developments.

What if There Is a Problem With My Plan Manager?

You are always in the driver's seat. If you're not happy with the service you're getting, you have clear rights and pathways to sort things out.

Any good plan manager will have a straightforward process for you to raise concerns or make a complaint. But remember, the ultimate control is yours. You have the right to switch plan managers at any time if you feel they aren't meeting your needs or acting in your best interest. This keeps providers accountable and ensures you're partnered with someone you genuinely trust.

At NIR Navigator In Reach, we believe in total transparency. Our goal is to empower you with the tools and clear information you need to feel confident in your NDIS journey. Our open-source approach is designed to simplify everything, from start to finish. Learn more about how we can support you.