Your Ultimate NDIS Plan Management Guide | Maximise Funding

This complete NDIS plan management guide is your simple walkthrough to understanding your funding options. We’ve put this together to show you how you can get full control over your supports, but without the headache of managing invoices and budgets yourself.

What Is NDIS Plan Management?

So, what exactly is NDIS plan management? Think of it like having a personal bookkeeper for your NDIS funds. It’s one of the three main ways you can handle your plan's budget, and it sits right in that sweet spot between doing it all yourself (self-management) and having the NDIA manage it for you (Agency-managed).

A Plan Manager is an independent expert whose only job is to look after the financial side of your plan. They aren't the ones providing your day-to-day supports. Instead, they act as the go-between, making sure your providers are paid correctly and on time. This takes a huge weight off your shoulders, freeing you up to focus on what really matters—kicking your goals.

The Role of Your Plan Manager

Let's get down to the nuts and bolts. What does a Plan Manager actually do for you? Their tasks are pretty straightforward and all about making your life easier.

- Paying Invoices: They get the bills directly from your support providers and pay them using your NDIS funds. No more chasing up invoices for you.

- Tracking Your Spending: They keep a close eye on every dollar spent, so you’ll always have a clear picture of how your budget is tracking.

- Providing Monthly Reports: You'll get clear, easy-to-read statements showing exactly what's been spent and what you have left.

- Managing NDIS Claims: They take care of all the communication and claims processing with the National Disability Insurance Agency (NDIA).

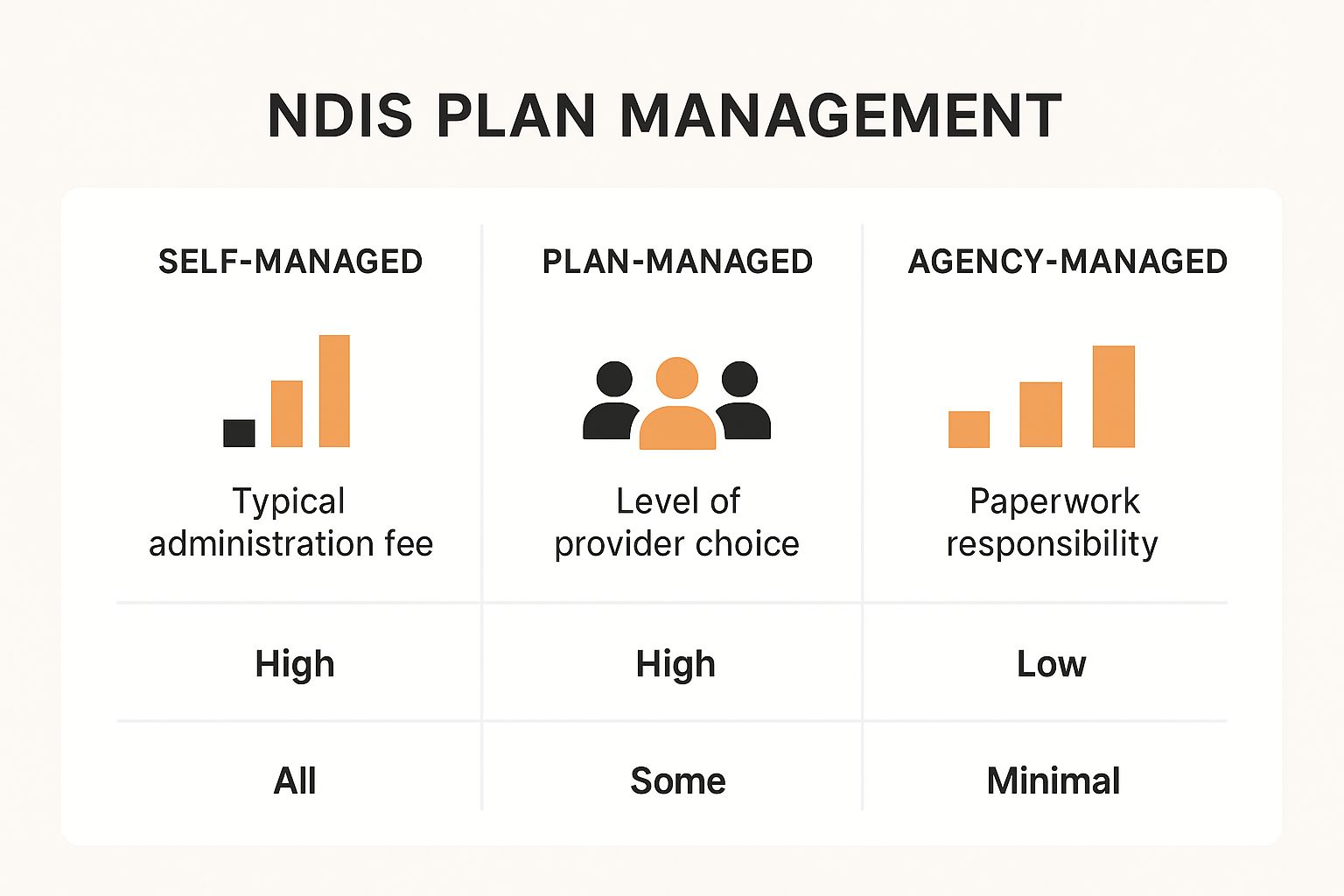

To help you visualise this, here’s a quick comparison to see exactly where Plan Management fits and why it's such a popular choice for participants.

Your Three NDIS Funding Management Options

| Management Option | Who Pays Providers? | Provider Choice | Key Benefit |

|---|---|---|---|

| Agency-Managed | The NDIA pays them directly. | Only NDIS-registered providers. | Least amount of personal admin. |

| Plan-Managed | Your Plan Manager pays them. | NDIS-registered and non-registered providers. | Choice and control without the paperwork. |

| Self-Managed | You pay them directly. | NDIS-registered and non-registered providers. | Maximum flexibility and control. |

This table shows that while Plan Management has a small administrative fee (which is fully covered by the NDIS, by the way), it gives you the ultimate provider choice with minimal personal admin. It’s the best of both worlds.

This infographic below also breaks down the three funding management options, highlighting the key differences in how they work.

As you can see, Plan Management really strikes that perfect balance.

Why Is It a Popular Choice?

It’s no surprise that so many participants are choosing Plan Management. It offers the same freedom and flexibility you get with self-management—like the ability to use non-registered providers—but without the stress of managing all the money yourself.

This blend of control and convenience is what makes it so appealing.

The real purpose of plan management is to give you choice and control over your supports without the stress of financial administration. It’s all about empowerment through expert support.

Simply put, you get to direct your own services, and your Plan Manager handles the bills. This clear separation lets you focus on building great relationships with your providers while a trusted expert minds the numbers.

If you're keen to learn more, you can explore other helpful NDIS guides and resources to really build up your knowledge. This approach makes sure you stay firmly in the driver’s seat of your NDIS journey.

Key Benefits of Using a Plan Manager

Opting for a plan manager is about so much more than just getting bills paid. It's about unlocking a level of flexibility and freedom that can genuinely change your NDIS experience for the better. It’s no surprise that a significant majority of NDIS participants—over 57%, in fact—now choose plan management to handle their funds.

Think of it as upgrading your NDIS plan from a standard package to a premium one, but without any extra cost to you. Suddenly, you have access to a wider world of supports, all while someone else takes care of the time-consuming admin.

This approach puts you firmly in the driver's seat, blending professional financial oversight with your personal expertise on what works for you. Let's dig into what that actually looks like day-to-day.

Greater Choice and Control Over Providers

One of the biggest game-changers with plan management is the freedom it gives you to choose your providers. If you're Agency-managed, you're locked into using only NDIS-registered providers. Plan management blows those doors wide open.

This means you can hire that local therapist everyone recommends, a trusted gardener from your community, or a support worker you already know, even if they aren't NDIS-registered. As long as the support is reasonable and necessary and helps you meet your plan goals, you're good to go.

This level of choice is everything. It lets you build a support network that truly fits your life, your location, and your preferences, instead of being stuck with what’s available in a directory.

Say Goodbye to Financial Administration

Let's be honest, the paperwork involved in managing NDIS funding can be overwhelming. Chasing invoices, ensuring bills are paid on time, keeping perfect records, and worrying about audits can feel like a full-time job in itself.

A plan manager takes all of that off your shoulders.

By handing over the financial management, you get your time and energy back to focus on what really matters: your health, your well-being, and actually achieving your goals.

Your plan manager deals with all the provider communication about invoices and makes sure every payment is processed correctly and claimed from the NDIA. This doesn't just save you hours of work; it massively reduces the stress that comes with juggling a complex budget.

More Effective Budget Management

Knowing exactly where your NDIS funds are going is crucial for making them work harder and last longer. A good plan manager gives you simple, clear, and regular financial statements that you can actually understand.

These reports are like your NDIS financial dashboard, showing you:

- How much you've spent in each of your support categories.

- The remaining budget you have left to use.

- A detailed breakdown of every single invoice paid on your behalf.

This transparency allows you to make smart, informed decisions throughout your plan. If you notice you're underspending in one area, you can chat with your support coordinator about how to redirect those funds. On the other hand, if a budget is getting tight, you can make adjustments before it becomes a problem.

This complete financial picture, as explained in a comprehensive NDIS plan management guide, empowers you to use your funding more strategically. You can plan ahead with confidence, knowing you have an expert keeping an eye on the numbers and making sure every dollar is accounted for, helping you get the absolute most out of your plan.

How to Choose the Right NDIS Plan Manager

Choosing your plan manager is one of the most important decisions you’ll make on your NDIS journey. This isn’t just about finding someone to pay the bills. It’s about partnering with a trusted professional who understands your goals, protects your funding, and ultimately, makes your life easier.

With so many providers out there, it can feel a bit overwhelming trying to figure out where to even start. The right partner for you will match your communication style, your comfort with technology, and your need for prompt, reliable service. This part of our guide is here to give you a clear framework so you can make a choice you feel good about.

Key Questions to Ask Potential Providers

Before you sign any service agreement, it's so important to ask a few direct questions. How they answer will tell you a lot about their processes, their approach to customer service, and whether they're genuinely the right fit for you.

Think of it like an interview where you’re the one in the driver's seat. Here are the essential questions you should have ready:

- What’s your average invoice processing time? A quick turnaround is non-negotiable. You don't want slow payments to strain your relationships with the support providers you rely on. Look for a manager who commits to processing clean invoices within 2-5 business days.

- How can I approve invoices? Do they give you options? Maybe you prefer a simple email reply, a quick tap in an app, or logging into an online portal. A good manager offers the flexibility to work the way you want to.

- What communication methods do you offer? Can you easily get a real person on the phone? Or are you stuck with emails and web forms? Make sure their communication style aligns with what works best for you.

- What can your online portal or app actually do? Don’t be afraid to ask for a demo or even just some screenshots. A great portal gives you real-time budget tracking, a clear history of paid invoices, and easy-to-read spending reports. It should empower you, not confuse you.

A provider’s answers to these practical, day-to-day questions will give you a very clear picture of what it's actually like to work with them.

Evaluating Their Stability and Expertise

The plan management space has been going through some major shifts lately. Because of this, it's more important than ever to pick a provider that's stable, experienced, and built to last.

Recent financial pressures have really shaken up the market. A multi-year freeze on the monthly plan management fee, combined with the removal of setup fees, squeezed providers' incomes. This has led to a lot of consolidation in the industry, with forecasts predicting a big drop in the number of active plan managers. You can get more insights into these market changes and what they mean for participants.

This makes it absolutely crucial to ask about a provider’s long-term stability.

When you choose a plan manager, you are trusting them with the financial engine of your NDIS plan. It's essential to ensure they are not only competent but also financially stable and compliant.

Look for signs of professionalism and a commitment to being around for the long haul. Does the provider have any industry certifications, like an ISO certification for information security? While it’s not mandatory, things like this show they take quality and protecting your personal data seriously. You’re looking for a partner you can count on for the entire length of your plan, and hopefully, for many more to come. A good way to stay across these kinds of developments is to keep up with industry news and NDIS changes.

Finding the Perfect Fit for You

At the end of the day, the "best" plan manager is simply the one that’s best for you. Your needs and preferences are unique, and your provider should be a good match for them.

Try not to get swayed by flashy marketing alone. Think about what really matters for your NDIS journey.

- For the Tech-Savvy Participant: If you love using apps and having instant access to your data, you should prioritise a provider with a sleek, user-friendly digital platform. You want that budget information right at your fingertips.

- For the Person-to-Person Communicator: If you’d much rather pick up the phone and chat with a familiar voice, then a smaller or local provider known for personalised, one-on-one service might be your best bet.

- For Those with Complex Needs: If your plan is large or you work with a lot of different support providers, you’ll need a manager with a robust system and a proven track record of handling high volumes of invoices with accuracy and efficiency.

Take your time with this decision. Read reviews, talk to other people in the NDIS community, and trust your gut feeling. By asking the right questions and focusing on what you truly need, you can find a plan manager who will become an invaluable asset in helping you reach your goals.

Navigating Your NDIS Budget with a Plan Manager

At first glance, an NDIS budget can feel like trying to read a map in a foreign language. It's full of specific categories, line items, and rules that can easily leave you feeling lost. But when you bring a plan manager on board, that confusing document starts to look more like a clear roadmap to achieving your goals. They become your expert guide, making sure every dollar is put to work effectively and by the book.

Think of your NDIS funding as being sorted into three main 'buckets', each holding funds for a different purpose. Your plan manager's job is to know exactly which bucket to draw from for each support you use, keeping everything aligned with NDIS guidelines. This structure is designed to give you flexibility while making sure your funds are channelled towards building your skills and independence.

Let's break down these budget buckets and look at how to read your spending reports. We’ll turn them from confusing lists of numbers into powerful tools you can actually use.

Understanding Your Three Budget Buckets

Your NDIS funding is neatly organised into three main categories. Each one is set up to pay for different kinds of supports, and your plan manager makes sure every invoice gets paid from the correct one.

- Core Supports: This is your most flexible bucket of funding. It’s there to help with everyday activities and includes money for things like support workers, low-cost assistive technology, transport, and consumables. For the most part, you can move funds between the different sub-categories within your Core budget, which gives you a lot of choice and control.

- Capital Supports: This bucket is reserved for the bigger ticket items. It covers more expensive assistive technology (like a specialised bed or a modified vehicle) and home modifications. Funding in this category is a lot stricter and can generally only be used for the specific item it was approved for.

- Capacity Building Supports: This budget is all about investing in you. It’s designed to help you build skills and independence so you can rely less on paid supports over time. This is where you’ll find funding for therapies, help to find a job, or support to learn new life skills.

Your plan manager knows the ins and outs of these rules. So, when your physiotherapist sends an invoice, they’ll make sure it's paid from your Capacity Building funds, not your Core budget. Getting this right is absolutely vital for staying compliant.

How Your Plan Manager Ensures Compliance

A massive part of your plan manager's job is to be your financial gatekeeper. They meticulously check every single invoice to make sure it lines up with the NDIS Pricing Arrangements and Price Limits. This is a crucial step that protects you from accidentally overspending or paying for something that isn't considered a ‘reasonable and necessary’ support.

Your plan manager acts as a safety net, ensuring every dollar of your funding is spent correctly according to NDIS rules. This protects you from compliance risks and gives you complete peace of mind.

This process shields you from potential headaches down the track, like being asked to repay funds if an NDIS audit uncovers non-compliant spending. It’s a professional layer of protection that lets you use your plan with confidence, knowing an expert is double-checking everything behind the scenes.

Making Sense of Your Monthly Reports

One of the most powerful tools your plan manager gives you is a monthly spending report. It might look like just a list of numbers at first, but it’s actually telling the story of your progress. Learning how to read it is the key to getting the most out of your budget.

A good report will clearly show you:

- Opening and Closing Balances: How much funding you started with and what's left in each of your budget buckets.

- Spending by Category: A simple breakdown of where your money has gone, with totals for Core, Capital, and Capacity Building.

- Detailed Invoice List: A line-by-line summary of every provider who has been paid, the date of the service, and the exact amount.

By sitting down and reviewing these reports, maybe with your plan manager or support coordinator, you can start to spot trends. Are you consistently underspending in one area? That’s a brilliant conversation starter for your next plan review—you might be able to move those funds to where you need them more. It can also be really helpful to see how other people have made their funding work for them; you can read about some of their journeys in our collection of client stories and experiences.

Ultimately, these reports empower you to take charge of your NDIS journey, turning your plan from a static budget into a dynamic tool for living a better life.

How Your Invoices Get Paid

So, how does the money actually move from your NDIS plan to your providers? Seeing how a plan manager handles your invoices day-to-day really shows you just how convenient the service is. It’s a smooth process that hums along in the background, freeing up your time and energy while making sure your trusted providers are paid on time.

The whole thing is designed to shield you from the financial admin and stress. It all starts the moment you finish a support session. From there, a simple, organised workflow kicks off, handled almost entirely by your plan manager. Let’s walk through what happens, so you’re clear on your role and the important work your plan manager does for you.

The Invoice Journey Step by Step

Once you’ve had a support session, your provider creates an invoice. But instead of sending it to you, they send it straight to your plan manager. You're no longer the go-between.

Here’s a breakdown of what happens next:

- Invoice Arrives: Your plan manager gets the invoice from your provider, usually by email or through a dedicated online portal.

- You Give the Go-Ahead: Now it's your turn. The plan manager will ask for your approval. This is your most important job in the process and a crucial check. A simple email reply or a quick click in their app is usually all it takes to confirm the service happened as described.

- Verification and Checks: With your approval, your plan manager gets to work. They meticulously check the invoice to make sure it ticks all the NDIS boxes, has the correct ABN, and the prices are within the official NDIS Price Guide limits.

- Payment Processing: Once everything is verified, your plan manager pays the provider directly from your NDIS funds.

- NDIA Claim: The final step is for the plan manager to claim those funds back from the NDIA through the government's online portal, squaring everything away.

This whole setup ensures you have the final say on which invoices get paid, but without any of the hands-on financial busywork.

Your Advocate in Financial Matters

Let's be realistic—sometimes invoices have issues. There might be a mistake in the amount, an incorrect date, or a service description that doesn't quite match what you received. This is where a great plan manager really proves their worth.

Instead of you having to make a potentially awkward call to your provider, your plan manager steps in as your professional advocate. They'll contact the provider directly to query the invoice and get a corrected version sent over. This keeps your relationship with your support team positive and focused on what matters: your support. To get a better sense of the official rules, it’s helpful to understand the standard NDIS policies and procedures that guide these interactions.

A plan manager is more than a payment processor; they are your financial safeguard. They handle disputes and resolve errors, ensuring your funding is always used correctly and your provider relationships remain strong.

The sheer scale of plan management speaks volumes about its value. As of March 2025, the NDIS supported 263,145 active providers. A massive 191,467 of them were working with plan-managed participants—far more than any other management type. This isn't a coincidence. It shows just how many people prefer to focus on their goals while letting an expert handle the financial side of their plan.

Making the Switch to Plan Management

Thinking about moving away from being self-managed or Agency-managed? If you like the sound of having more choice over your supports but without the mountain of paperwork, you'll be happy to know that switching to plan management is surprisingly easy.

It’s a common misconception that you’re locked in until your next plan review. That’s simply not the case. You can ask to switch to plan management at any time during your current NDIS plan. The process is designed to be quick and put you firmly in the driver's seat.

Let's walk through just how simple it is to make the move, so you can feel confident about taking the next step. The first move is just letting the NDIA know what you want to do. You don't need an elaborate reason—simply wanting more control and less admin is more than enough.

The Two Simple Steps to Switch

Making the change really boils down to just two key actions. It's a fast process that gives you control almost immediately.

- Request the Change: All you need to do is contact your Local Area Coordinator (LAC), Early Childhood Partner, or the NDIA directly. A quick phone call or email is enough to get the ball rolling. Just tell them you’d like to move to plan management.

- Choose Your Plan Manager: Once your request is in, you just need to find a plan manager you're happy with and sign a service agreement with them. They handle the rest, letting the NDIA know they're your chosen provider. And that's it—the switch is done.

Seriously, that’s all there is to it. No long, complicated forms or daunting meetings. It's one of the most straightforward changes you can make within your NDIS plan. Before you sign on with any new provider, it's always smart to brush up on the fundamentals of NDIS contracts and service agreements to know exactly what you’re agreeing to.

Will It Cost Me Anything?

This is a big one, and a question we hear all the time. Let’s clear it up: switching to plan management will not reduce the funding you have for your other supports. Not one cent.

The funding for plan management fees is added on top of your existing budget. It comes from a separate category called 'Improved Life Choices' and never takes away from your Core, Capital, or Capacity Building funds.

Think of it as the NDIS covering the cost of having a financial expert in your corner so you don’t have to worry about it. This means you get all the benefits—expert support, greater choice of providers, and zero paperwork headaches—at no cost to your therapy and support budgets.

This feature alone makes plan management a genuinely powerful choice for anyone wanting to get more control over their NDIS plan without the financial stress. It’s an easy step toward greater peace of mind.

NDIS Plan Management Frequently Asked Questions

It's only natural to have questions as you get to grips with your NDIS plan. This is where we'll tackle some of the most common things people ask about plan management, offering straightforward answers to give you clarity and confidence.

Think of this as your quick reference guide. We want to clear up any confusion and provide information you can use right away.

How Much Does NDIS Plan Management Cost?

This is usually the first question on everyone's mind, and the answer is refreshingly simple: it costs you nothing out of pocket.

Plan management is a service that's fully funded by the NDIS. If you decide it's the right choice for you, the NDIS adds specific funding to your plan under the ‘Improved Life Choices’ budget category to cover the cost.

The key thing to understand is that this funding is completely separate from the money for your other supports. It’s an extra line item, which means it doesn't take a single dollar away from your budget for therapies, equipment, or support workers. You get professional help managing your funds without compromising your care.

Can I Use Non-Registered NDIS Providers?

Yes, you certainly can. This is one of the biggest benefits of having a plan manager and a major reason why it’s such a popular choice.

When your plan is managed by the NDIA (Agency-managed), you're limited to using only NDIS-registered providers. Plan management blows those restrictions wide open, giving you the freedom to choose services from both registered and non-registered providers.

This flexibility opens up a much bigger world of support. It means you can choose:

- A fantastic local therapist who’s been recommended by people in your community.

- The gardener or cleaner you’ve used for years and already trust.

- Specialised services from small businesses or sole traders who aren't registered with the NDIS.

As long as the support helps you meet your plan goals and is considered reasonable and necessary, the choice is yours. This is what real choice and control looks like in practice.

What if I Have a Problem with My Plan Manager?

You are always in the driver's seat and have clear steps you can take if things aren't working out. Your rights as an NDIS participant are well-protected, and you're never stuck with a provider who isn't meeting your needs.

The best first step is always to talk directly to your plan manager. Often, a simple misunderstanding is at the heart of the problem, and a quick phone call or email can sort it out.

If you’ve tried that and you’re still not happy with the result, you absolutely have the right to take it further. You can escalate the issue by lodging a complaint with the NDIS Quality and Safeguards Commission. They are an independent agency set up specifically to protect your rights and make sure providers are delivering safe, high-quality services.

And remember, you are always free to switch plan managers at any time if you feel your current one isn't the right fit. The power to choose and control your supports always rests with you.

At NIR Navigator In Reach, our goal is to make your NDIS journey feel clear and manageable. Through our transparent support coordination, we help you make decisions with confidence, making sure your plan is always working for you. Learn how we can simplify your NDIS experience today.